Client Alerts

Hart-Scott-Rodino Filing Thresholds Jump Significantly in 2024

March 2024

Client Alerts

Hart-Scott-Rodino Filing Thresholds Jump Significantly in 2024

March 2024

Effective March 6, 2024, the minimum dollar thresholds under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and its rules and regulations (the HSR Act) will increase by over $8 million. The thresholds determine whether companies are required to notify federal antitrust authorities before consummating a transaction. The increased thresholds will provide both buyer and seller more leeway to possibly avoid the expense and distraction of filing for antitrust clearance before closing a transaction.

The HSR Act “size of transaction” threshold will increase from $111.4 million to $119.5 million. Transactions in which the acquiring party will hold voting securities, non-corporate interests, or assets valued above $119.5 million (as determined under the HSR Act’s rules and regulations) may require a pre-merger notification if the “size of parties” test is also achieved and no HSR Act exemptions are applicable. The closing date of the transaction determines which threshold applies. As a result, any transaction closed after March 6, 2024 will be subject to the higher threshold.

For transactions valued at more than $119.5 million but less than $478 million, the “size of parties” test thresholds will also increase. Generally, the ultimate parent entity of one party to the transaction must have annual net sales or total assets of at least $168.8 million (up from $161.5 million) and the ultimate parent entity of the other party must have annual net sales or total assets of at least $23.9 million (up from $22.3 million). Transactions valued at $478 million (up from $445.5 million) or more must be reported, regardless of the size of parties involved in the transaction, unless an exemption applies.

The Federal Trade Commission (FTC) is required by law to annually revise these jurisdictional HSR Act thresholds based upon the change in gross national product. The HSR Act requires companies of a certain size involved in a transaction that exceeds the filing thresholds to file a pre-merger notification with the FTC and Department of Justice and observe a waiting period unless an HSR Act exemption applies.

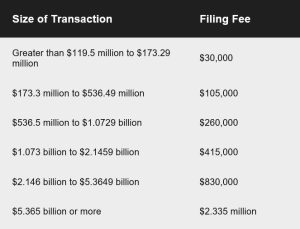

The applicable HSR Act filing fees and thresholds will also increase. As of March 6, 2024, the filing fees and associated thresholds is as follows:

Finally, effective January 10, 2024, the FTC increased the maximum daily civil penalties for noncompliance with HSR requirements to up to $51,744 for each day of violation. The annual increase is based on the increase in the gross national product.

If you are evaluating a business acquisition or divestiture, keep these filing thresholds in mind. An HSR filing can delay closing and add cost to the deal.

ADDITIONAL INFORMATION

For more information, please contact:

- Tod Northman | 216.696.5469 | tod.northman@tuckerellis.com

- Jayne E. Juvan | 216.696.5677 | jayne.juvan@tuckerellis.com

- Christopher J. Hewitt | 216.696.2691 | christopher.hewitt@tuckerellis.com

- Brian M. O’Neill | 216.696.5590 | brian.oneill@tuckerellis.com

- Thomas R. Peppard, Jr. | 216.696.5267 | thomas.peppard@tuckerellis.com

This Client Alert has been prepared by Tucker Ellis LLP for the use of our clients. Although prepared by professionals, it should not be used as a substitute for legal counseling in specific situations. Readers should not act upon the information contained herein without professional guidance.