Client Alerts

SEC Proposes Rules to Enhance Climate-Related Disclosures

March 2022

Client Alerts

SEC Proposes Rules to Enhance Climate-Related Disclosures

March 2022

For many investors, climate change and climate-related initiatives hover at the forefront of their concerns when investing. Following its 2010 guidance on climate-related disclosures and to further address these concerns, the SEC has now issued proposed rules to mandate SEC registrants to include climate-related disclosures (“Climate-Related Disclosures”) in certain reports (such as 10-Ks) and registration statements. The SEC proposed rule, issued March 21, relies on the principle of investor protection on the basis that a registrant’s action and/or inaction on climate could potentially expose investors to financial risk. The proposed Climate-Related Disclosures seek to enhance disclosure and standardize reporting obligations among registrants to better inform investors interested in mitigating such risk – ultimately resulting in more useful information for investors making investment decisions.

The SEC’s goal is to optimize investor protection so that each registrant is on a level playing field on Climate-Related Disclosures. According to the SEC, investors can make comparisons among registrants regarding how climate-change and climate-related issues affect the registrant’s business operations and financial circumstances, thereby enabling investors to make more informed capital allocation decisions.

The SEC proposed rules would require registrants to disclose information (pursuant to the phase-in schedule) about its climate-related risks and related business strategies, as well as information regarding its specific emissions. More specifically, as listed on the Enhancement and Standardization of Climate-Related Disclosures Fact Sheet, the proposed rules would require a registrant to:

- Disclose climate-related risks:

- The oversight and governance of climate-related risks by the registrant’s board and management

- How any climate-related risks identified by the registrant have had or may have a material impact on its business and consolidated financial statements

- How any climate-related risks might have affected strategy, business model, and outlook

- Disclose climate-related risk identification:

- The registrant’s process for identifying and assessing climate-related risks, and whether such processes are integrated into the registrant’s overall risk management system or process

- Information regarding any potential transition plan the registrant may have adopted as part of its climate-related risk management strategy

- Any scenario analysis the registrant uses to assess the resilience of its business strategy to climate-related risks

- Disclose climate-related business and financial impact on issuer:

- If a registrant uses an internal carbon price, information about how it is set

- The impact of climate-related events (such as severe weather or other natural conditions) and transition activities on the line items of a registrant’s consolidated financial statements

- The registrant’s direct greenhouse gas (“GHG”) emissions (Scope 1) and indirect GHG emissions from purchased electricity and other forms of energy (Scope 2), separately disclosed, expressed both by disaggregated constituent GHG and in the aggregate, and in absolute terms, not including offsets, and in terms of intensity (per unit of economic value or production)

- Indirect emissions from upstream and downstream activities in a registrant’s value chain (Scope 3), if material, or if the registrant has set a GHG emissions target or goal that includes Scope 3 emissions, in absolute terms, not including offsets, and in terms of intensity

- If the registrant has publicly set climate-related targets or goals, disclose information about:

- The scope of activities and emissions included in the target, the defined time horizon by which the target is intended to be achieved, and any interim targets;

- How the registrant intends to meet its climate-related targets or goals;

- Relevant data regarding whether the registrant is making progress toward meeting the target or goal; and

- If carbon offsets or renewable energy certificates have been used as part of the registrant’s plan to achieve climate-related targets or goals and other such relevant information

The above-described disclosure framework would require a registrant to take the following actions:

- Provide the Regulation S-K mandated Climate-Related Disclosure in a separate, appropriately captioned section of its registration statement or Form 10-K;

- Provide the Regulation S-X mandated climate-related financial statement metrics and related disclosure in a note to its consolidated financial statements;

- Electronically tag both narrative and quantitative c=Climate-Related Disclosures in Inline XBRL; and

- If an accelerated or large accelerated filer, obtain an attestation report from an independent attestation service provider covering, at a minimum, Scopes 1 and 2 GHG emissions disclosures.

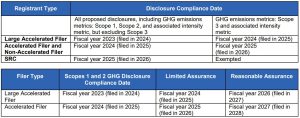

Phase-In Periods and Accommodations for the Proposed Climate-Related Disclosures

Over a period of three years, the SEC will phase in the Climate-Related Disclosure rules, starting with large accelerated filers in fiscal year 2023, followed by accelerated filers and non-accelerated filers in fiscal year 2024, and, finally, smaller reporting companies (“SRCs”) in fiscal year 2025 (with an exemption from Scope 3 gas house emission disclosures). Third-party independent attestation reports covering GHG emissions disclosures would be phased in starting in 2024. Additionally, accommodations would include a forward-looking statement safe harbor pursuant to the Private Securities Litigation Reform Act, to the extent that proposed disclosures would include forward-looking statements.

There is no doubt that, if the proposed Climate-Related Disclosures are adopted as proposed, they will impose substantial burdens and costs on registrants, further increasing the cost of remaining an SEC reporting company. The costs in the first year of compliance for non-SRC registrants are estimated by the SEC to be $640,000 ($180,000 for internal costs and $460,000 for outside professional costs), with annual costs in subsequent years estimated to be $350,000. For SRC registrants, the costs in the first year of compliance are estimated to be $490,000 ($140,000 for internal costs and $350,000 for outside professional costs), with annual costs in subsequent years estimated to be $420,000. Costs may decrease over time as institutional knowledge increases and a market for relevant services emerges.

Given such high costs, we anticipate that the comments and criticism on the proposed rules will be substantive and extensive and will highlight the view that the new rules (i) mandate disclosures for all companies without regard to whether they are material, and (ii) are unnecessary because existing SEC disclosure rules already require companies to disclose material risks, including climate-related risks. One dissenting Commissioner has opined that the proposed Climate-Related Disclosure rules exceed the SEC’s statutory authority; we anticipate litigation to challenge them.

The comment period on the proposed Climate-Related Disclosures will remain open until at least May 20, 2022.

ADDITIONAL INFORMATION

For more information, please contact:

- Kristen A. Baracy | 213.430.3603 | kristen.baracy@tuckerellis.com

- Robert M. Loesch | 216.696.5916 | robert.loesch@tuckerellis.com

- Glenn E. Morrical | 216.696.3431 | glenn.morrical@tuckerellis.com

This Client Alert has been prepared by Tucker Ellis LLP for the use of our clients. Although prepared by professionals, it should not be used as a substitute for legal counseling in specific situations. Readers should not act upon the information contained herein without professional guidance.